Insight into a new mutual fund category: Focused Funds

The difference between a focused fund and more diversified equity funds is that focused funds have a concentrated portfo...

Many investors still think of mutual funds as a way of investing in equities. As per AMFI, nearly 70% of retail and HNI assets were invested in equity funds in August 2020. However, mutual funds offer investment solution for a variety of investment needs for investors in all age groups.

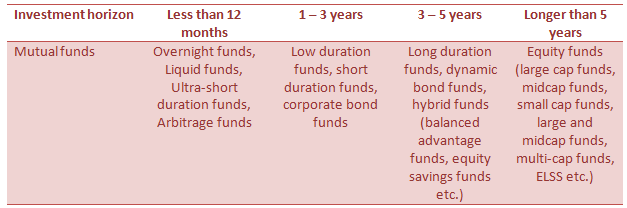

You can invest in mutual funds to park money for a few months to few years to earn potentially higher return than bank deposits and other traditional investments. Mutual funds are ideal for planning your life-stage goals like retirement, children’s higher education etc. Mutual funds can also help you create an income stream for you in your retirement, plan your estate, so on so forth.

Different mutual funds have different risk return profiles. Selecting a mutual fund which is suitable for your risk appetite is must in order to meet your financial goals.

You need to define different financial goals so that you can build an investment plan to meet these goals. Goal planning involves articulating the purpose of your financial goals in different stages of life, e.g. purchasing a property, paying off loans, children’s higher education, children’s marriage, retirement planning, leaving an estate for your loved ones etc. One of the most important aspects of goal planning is quantifying these goals so that you have an actionable plan i.e. how much to invest and for how long, where to investment and picking the right mutual fund. You should remember that purchasing power of money reduces over time and therefore, you should always factor in inflation when setting goal targets.

Risk refers to an adverse financial outcome against your expectations. Some people have higher capacity to take risks than others. Your risk appetite depends on your age, stage of life, personal and financial situation. For example, a young person will have higher risk appetite than someone close to retirement. A person with no financial liabilities will have higher risk appetite than a person with debts. You should always invest according to your risk appetite.

Risk appetite can be different from your attitude towards risk. For example, a young, first time investor is likely to have different emotional reaction to a deep market correction compared to an experienced investor who has seen multiple bear markets. Investors’ actions are often influenced by their attitude towards risk e.g. redeeming your mutual fund when market falls and this can harm your financial interest. Mutual funds offer products of different risk profiles within the same asset class e.g. risk profile of large cap funds is lower than midcap or small cap funds. Therefore, picking the right mutual fund is of utmost importance. A new investor may start by investing in large cap funds and then gradually add midcap or small cap to his / her portfolio as he / she gains experience.

Different asset classes have different risk profiles e.g. debt mutual funds have lower risk profiles than equity funds. The risk profile of hybrid funds (which invest in both, debt and equity) is intermediate between debt and equity funds. You should understand that risk and return are directly related.

Asset allocation aims to balance risk and return in achieving your financial goals. If your risk appetite is higher, you can have higher allocation to equity and vice versa. You should invest in the right asset class depending on your financial goal and risk appetite.

Asset allocation is one of the most important aspects of financial planning because it will determine whether your portfolio is able to generate sufficient returns to meet your financial goals. At the same time, asset allocation will also reduce downside risks in the event of adverse market movements. You should always have a portfolio perspective when managing your asset allocation. Successful investors have target asset allocations depending on their risk appetite and goals for different stages of life.

Mutual fund selection if done properly can be excellent instruments for managing your asset allocation because they offer different schemes for different asset classes and sub-classes. You switch between schemes, get fixed cash-flows through SWP or invest through STP subject to exit load and taxation considerations.

Disclaimer: The above fund category suggestion is purely illustrative for general guidance. Mutual funds are subject to market risks. You should always invest according to your financial goals and risk appetite. You should consult with your financial advisor before investing..

In this article, you have discussed factors you should consider when investing in a mutual fund scheme so that you can select the best mutual fund. You should also check the long term track record of the mutual fund scheme, its fund manager and also the fund house before picking the right mutual fund. Select Mutual Funds whose managers have strong performance track records. You may also like to read do you know the most important parameters in selecting mutual funds.

You should always take the help of a financial advisor if you have difficulties in understanding the investment characteristics of mutual funds.

Resources: advisorkhoj.com.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.